Diagonals are usually identified by overlapping wave 1 and 4.The trend lines must converge, slope in the same direction.Wave 3 must be greater than wave 2 by price.Wave 4 never moves beyond the end of wave 2.Wave 2 must not retrace more than 100% of wave 1.Diagonals must move within the two channel lines or be within 10-15% of total movement.Ending diagonal can only form in subdivisions of wave 5 in an impulse, or wave C in a zigzag.Leading diagonal can only form in subdivisions of wave 1 in an impulse, or in wave A in a zigzag.Ending diagonal subdivides into 3-3-3-3-3.Leading diagonal subdivides into 5-3-5-3-5.There are also two wedge forms for leading diagonals Contracting and Expanding

This is dependent on if they form at the start (leading) or end (ending) of an impulse wave, or the form of wave A (leading) or C (ending) of a zigzag. There are two types of diagonals leading and ending.

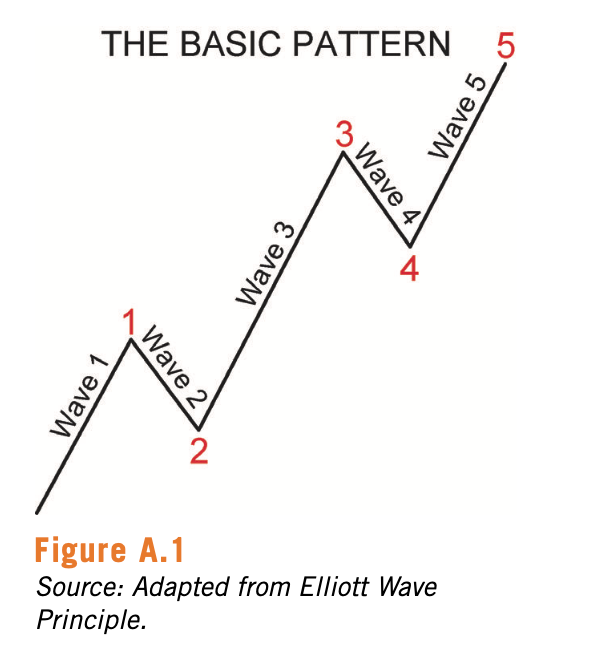

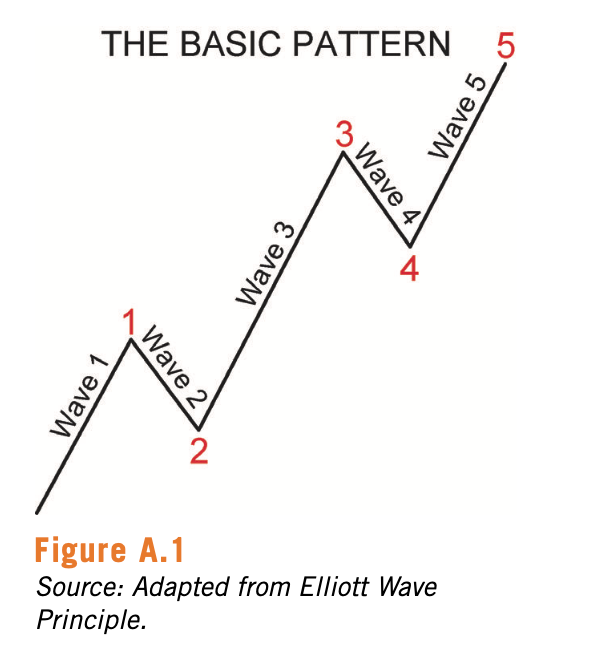

If wave 4 does exceed 50% of wave 3, consider a different count, but do not rule it outĭiagonals move within two channel lines drawn from waves 1 to 3, and from waves 2 to 4. Ideally it should not exceed more than 50%. If volume during the 5th wave is as high as the 3rd, an extended 5th wave is expectedįibonacci Extension & Retracement Ratios:. In most cases, wave 3 has the highest volume. Channel lines and Fibonacci targets are inferior to the wave count. Usually two of waves 1, 3 & 5 exhibit a Fibonacci ratio. Extended waves can contain exaggerated subdivisions within them. Wave 4 usually forms as a triangle, double/triple threes, or flat. Wave 2 usually forms as a zigzag or double/triple zigzag. Wave 2 typically retraces to deeper levels of wave 1, than wave 4 does relative to wave 3. See last page for more details on alternation. Waves 2 and 4 tend to create alternation between each other. When wave 3 extends, wave 5 tends to equal wave 1 in length. Wave 3 usually has the greatest extension. Truncation gives warning of underlying weakness or strength in the market. This is called truncation, but it is not very common. Wave 5 can fail to go beyond the end of wave 3. Wave 5 should end with momentum divergence (RSI is the simplest oscillator to spot this). Wave 1 is the least common wave to extend. Wave 4 can never move beyond the end of wave 1 (Otherwise it is a diagonal). Wave 2 cannot retrace more than 100% of wave 1. It can be shorter than wave 1 or 5, but never the shortest. Wave 1 and 5 always have to be an impulse, or a diagonal (Leading for wave 1 – Ending for wave 5). An impulse consists of 5 internal waves. They move in the same direction of the trend, and are the easiest to recognize. Wave 4 cannot overlap with the price territory of wave 1 (Except in the rare event of a diagonal triangle pattern)Īn impulse is the most common motive wave, which is always subdivided into five waves (1-3-5 up, 2-4 down ). Wave 3 cannot be the shortest of the three impulse waves.

Motivewave trade wave 2 download#

This will absolutely help with the learning curve and also be an excellent resource to have quick access to all the major rules, guidelines, structures, and Fibonacci measurements.įor more in-depth analysis on Elliott Waves, download & STUDY Elliott Wave Principle, known as “The Bible of the Elliott Wave Theory”, ( Yes, it’s free!!). This is a cheat sheet to use along your journey of becoming an elite elliotician. The idea is that each set of waves is ingrained within a larger set of waves that follow the same impulse/corrective pattern, described in fractality.

The theory isolates waves identified as motive waves that form a trend, and corrective waves that counter the trend. Named after Ralph Nelson Elliott, the Elliott Wave Theory is a method of technical analysis that identifies for recurring price patterns related to cycles in investor sentiment and psychology.

0 kommentar(er)

0 kommentar(er)